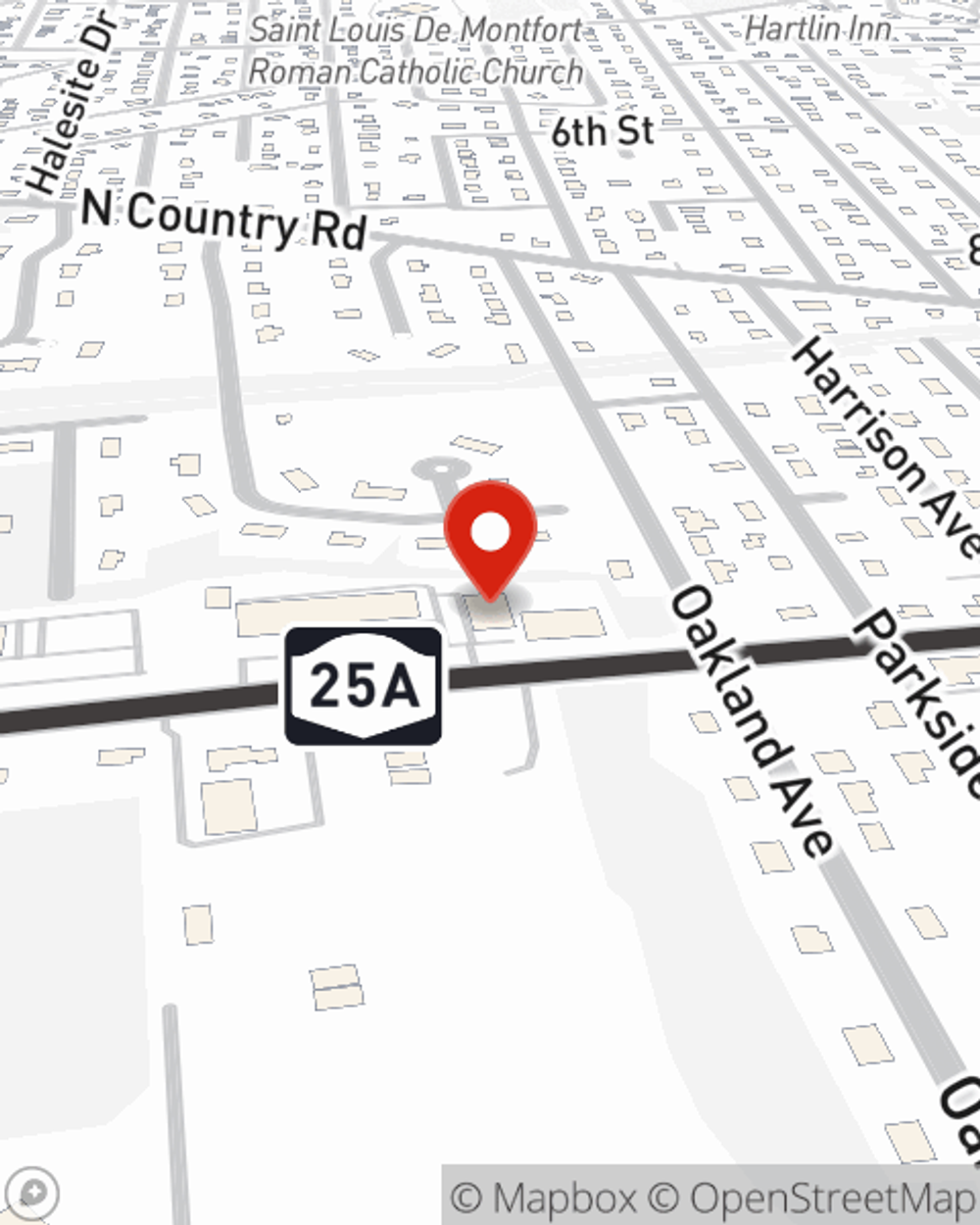

Business Insurance in and around Miller Place

Calling all small business owners of Miller Place!

This small business insurance is not risky

- Miller Place

- Mount Sinai

- Port Jefferson

- Rocky Point

- Wading River

- Shoreham

- Coram

- Centereach

- East Setauket

- Stony Brook

- Riverhead

- Selden

- Ridge

- Medford

- Middle Island

- St James

- Smithtown

- Ronkonkoma

- Patchogue

- Holbrook

- Hauppauge

- Brentwood

- Huntington

- Bohemia

This Coverage Is Worth It.

Small business owners like you have a lot on your plate. From social media manager to HR supervisor, you do as much as possible each day to make your business a success. Are you a piano tuner, a fence contractor or a dog groomer? Do you own a clothing store, a hobby shop or an ice cream shop? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Miller Place!

This small business insurance is not risky

Small Business Insurance You Can Count On

Your business is unique and faces a different set of challenges. Whether you are growing a bicycle shop or a bridal shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Laura San Nicolas can help with worker's compensation for your employees as well as life insurance for a group if there are 5 or more employees.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Laura San Nicolas's team to discuss the options specifically available to you!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Laura San Nicolas

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.